Unlock the power of not doing your payroll

Small business payroll that makes paying employees, contractors, and yourself, easy!

Hire, pay, and manage your team all in one place and

Run your payroll in minutes.

Full-service payroll

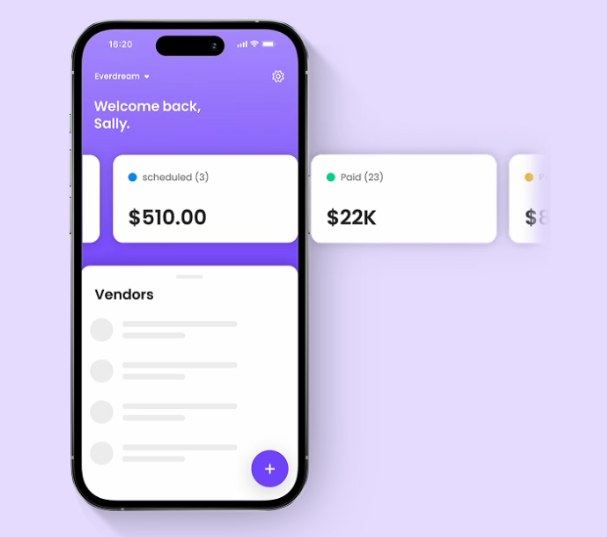

Running payroll is a breeze — even on your phone. It just takes a few clicks or taps to enter hours, review, and approve each pay run.

Automated tax filing

We handle all the federal, state, and local taxes, we guarantee our calculations, and provide dedicated support to answer any of your questions.

Built-in HR

Stay organized and automate team management with customized onboarding workflows, document audits, and more.

Easy payroll software for small business

Pay employees and contractors

Pay independent contractors and employees, and generate W2 and 1099 forms for tax season.

Direct deposit

Deposit payments quickly, reliably, and directly into your employees’ bank accounts. Less work for you, and your team will love it.

Protect your team with workers’ comp

Only pay for what you use and simplify annual audits with workers’ comp built for small business owners.

Automatic payroll journal entries

Our payroll software is seamlessly connected with the rest of your Beyond account to reduce the time you spend on manual bookkeeping.

Get more than just payroll

Cut costs in half with a low, single monthly fee – no matter how often you run payroll.

Running late, need more time? No problem, we’ve got you covered. With Beyond, you can process payroll by 3:30 p.m. (ET) and deposit paychecks the next business day.

Load wages directly onto Beyond’s payroll debit cards and give employees access to their funds in minutes.

Quickly apply for competitive loans to cover payroll expenses or fuel business growth, all within Beyond.

Make managing payroll effortless

Automated, accurate payroll helps you stay compliant, save time, and be stress-free.

Why our customers choose Beyond

“The best payroll processor we ever used! Beyond really helped us automate our payroll processing.”

Frequently Asked Questions

Payroll software automates payroll tasks, reducing errors and saving time. It can account for and automate tax calculations, generate reports, and streamline your entire payroll management. TLDR – payroll is highly complicated, and payroll software removes this burden from small business owners.

Yes, Beyond automatically generates W-2s and 1099s and sends digital copies to your employees and contractors.

You sure can! Beyond Payroll supports paying both employees and independent contractors when you run payroll. The proper tax forms—1099 in the US generated for you.

Every Beyond payroll plan is unlimited, so you don’t pay extra fees! Run payroll in minutes, anytime you want, at one price.

Beyond automates payroll tax calculations, deductions, and filings. Our platform and support team tracks changing tax rates and ensures timely submissions to tax authorities.

You don’t have to wait for a new quarter or year to start using payroll software—you can start running payroll at any time! And if you’re switching providers, you can make the transition easily by importing all the necessary forms and information in just a few minutes. Check out our handy support article to learn how you can switch to using Beyond’s payroll feature.